Stock picking and market timing is generally a fool’s game — the market is out of our control. What we can control is how we manage our investments. By focusing on the planning process, tax liability, expenses, and our behavior we are setting ourselves up for success and a positive investing experience.

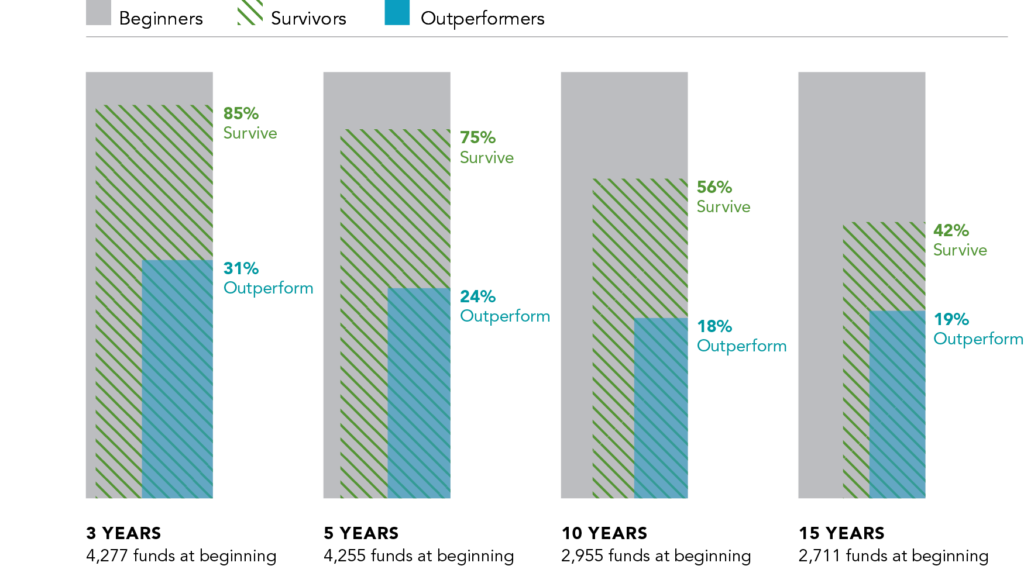

If I could tell you what the next hot stock, sector, or country is going to be I would not be able to. I would be too busy helicopter skiing, touring the world, and managing my personal treasure chest. One thing is becoming very clear in this world, investing with the intent to beat the market is a difficult task. The average number of trades in 2015 was 98 million trades PER DAY! The average trade volume was 447 billion dollars PER DAY![i] There is so much buying and selling in the market that is has become extremely difficult to get a leg up on the competition. Should an investor attempt to beat the market, research indicates their efforts will be futile. The chart below shows how active money managers, many of whom studied at top tier universities, fared against their benchmark return.

Let’s gamble. Let’s say you are on a game show and five doors are presented to you. Four of the doors reveal a pirate who takes your shoes and wallet, one of the doors rewards you with a dinner for two at one of the finest restaurants in town. Would you play? Many would walk away, but millions continually play this game year in and year out in search of superior returns. To compound the scenario many are doing so with decades of hard earned savings earmarked for perhaps the biggest purchase of their life, retirement.

So, if stock picking and timing the market is a fool’s game then what is there to do? By focusing on planning, tax liability, expenses, and behavior an investor can increase the likelihood of success and have a positive investing experience:

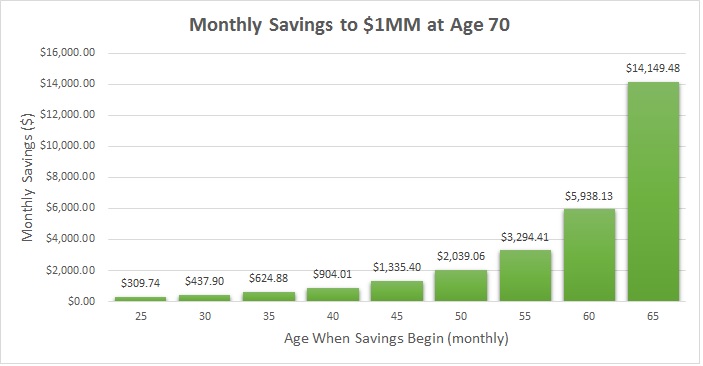

- Control the Planning Process: Warren Buffett once said, “Someone is sitting in the shade today because someone planted a tree a long time ago”. To paraphrase, we need to save and be patient before we can appreciate investment return. The planning process should be goal oriented and the chart below displays a goal of $1,000,000 or roughly $40,000 of retirement income per year. As we can see, planting the tree is much easier now than if we wait.

- Control Tax Liability: When we earn, our dollars typically go in one of three “buckets”: current spending, savings, and taxes. Whenever an investor can achieve desired investment returns and control taxes it is a win. Utilizing tax advantaged accounts, controlling realized gains, and utilizing tax efficient investments can all lead to a lower portion of earnings going to Uncle Sam. Likewise, proper planning can avoid costly mistakes. I do not know how many times I have heard someone incur a 10% withdrawal penalty on a retirement account withdrawal for the purchase of a new home. Simply saving outside the retirement account would have avoided the penalty altogether.

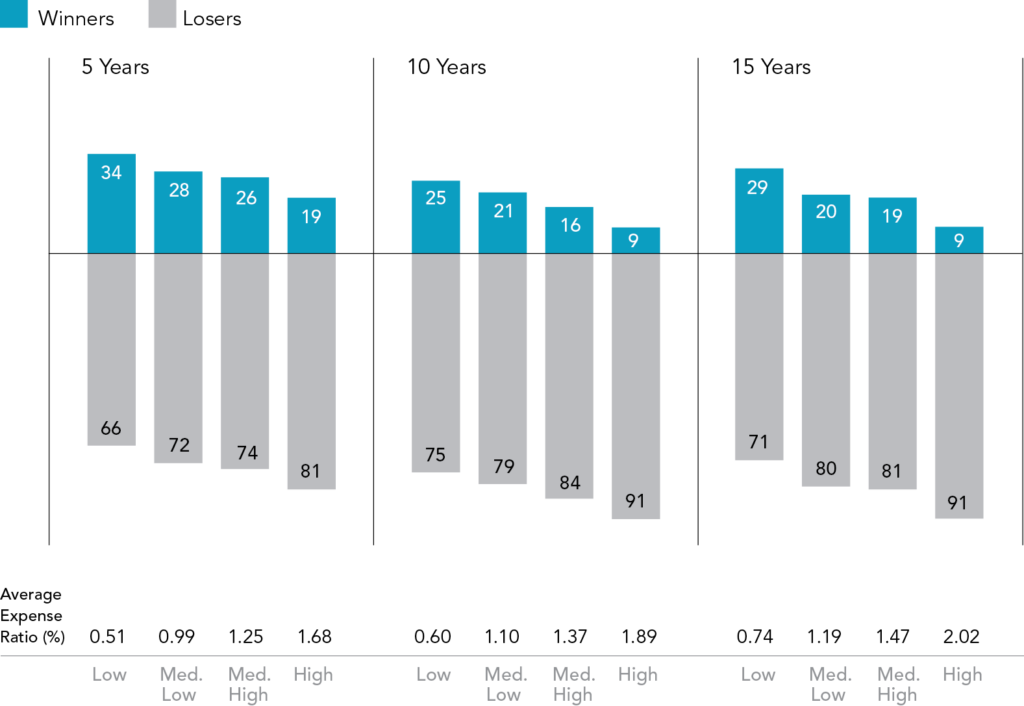

- Control Expenses: Making money is a business, and in the case of your finances the business is you. Anytime an investor can reduce costs those savings drop to the bottom line. Being conscious of how much you are paying in commissions, transaction fees, expense ratios, advisory fees, etc. is a worthwhile exercise for any investor. The chart below details over three time periods whether an active money manager beat the market benchmark based on the average expense ratio they charged. The higher the average expense ratio, the lower probability the manager will outperform the benchmark.

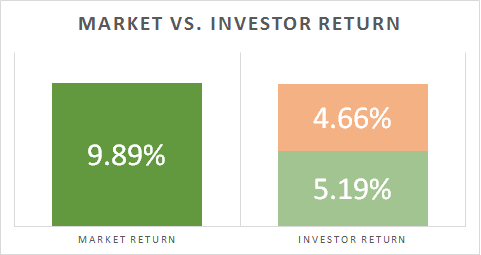

- Control Behavior: When faced with financial decisions we often become emotional, which can lead to irrational decisions and negatively affect investment return. Per a highly regarded annual study the 20-year return of retail investors averaged 5.19% while the return of the market (the benchmark) returned 9.89% — a difference of 4.66% per year![iv] After twenty years a $10,000 investment for the retail investor grew to $27,510 while the market grew to $65,464 — a difference of 138%! Maintaining sound financial behavior through thick and thin is very important and I believe is THE biggest determinant of investor success.

Outside stock picking and market timing there are many factors to consider when investing. Having a clear idea of where you want to go, being aware of expenses, tax liability and behavior are controllable factors that can lead to success.

Drew Hefflefinger is a CERTIFIED FINANCIAL PLANNER™ at Engage in Wealth in Denver, Colorado. Drew specializes in working with young professionals by helping them preserve and grow their wealth while achieving life goals. Drew can be contacted at drew@engageinwealth.com.

[i] Dimensional Fund Advisors, (2016).

[ii] Dimensional Fund Advisors, (2016).

[iii] Dimensional Fund Advisors, (2016).

[iv] DALBAR, (2015).

[ii]

[ii] [iii]

[iii]