Managing personal finances is stressful. With so many considerations, either immediate or in the future, it can feel overwhelming and cause unwarranted stress. Let’s address some of the basic causes of financial stress and how to best approach it.

Money and health: two of the most common causes of stress. By exercising, eating well, and understanding our bodies we can, for the most part, live healthy lives. By eating poorly, not exercising, and not understanding our bodies we become prone to injury and sickness which leads to unhealthy stress.

Same thing goes with our financial health. Understanding our goals, implementing tactful strategies, and understanding behavior leads to a healthy financial life. Living paycheck-to-paycheck, exercising poor investor behavior, and with no plan we are open to hardship. Financial hardship like mounting credit card debt, house/rent poor, and unable to achieve our retirement goals is stressful!

Now I am not a medical doctor, but I can be viewed as a ‘money doctor’ who can help when your finances are not feeling too well:

Living Paycheck-to-Paycheck: Living paycheck-to-paycheck, no matter your income, is a ticking time bomb. Unfortunate surprises happen and can lead to an uncomfortable situation if you do not have a “rainy day” fund to fall back on. Say for example you lose your job while living paycheck-to-paycheck… how long can you financially support yourself while you find a new job? Is the stress and pressure of making ends meet going to impede on your ability to find what is right for you? By having a “rainy day” fund you can live off reserves, find the right job, and get back on your feet in a healthy way.

This issue can also be applied to a variety of unexpected expenses including but not limited to: medical bills, tax return error, home repair, car repair, etc.. So stop living paycheck-to-paycheck, save a little each month, and take back control!

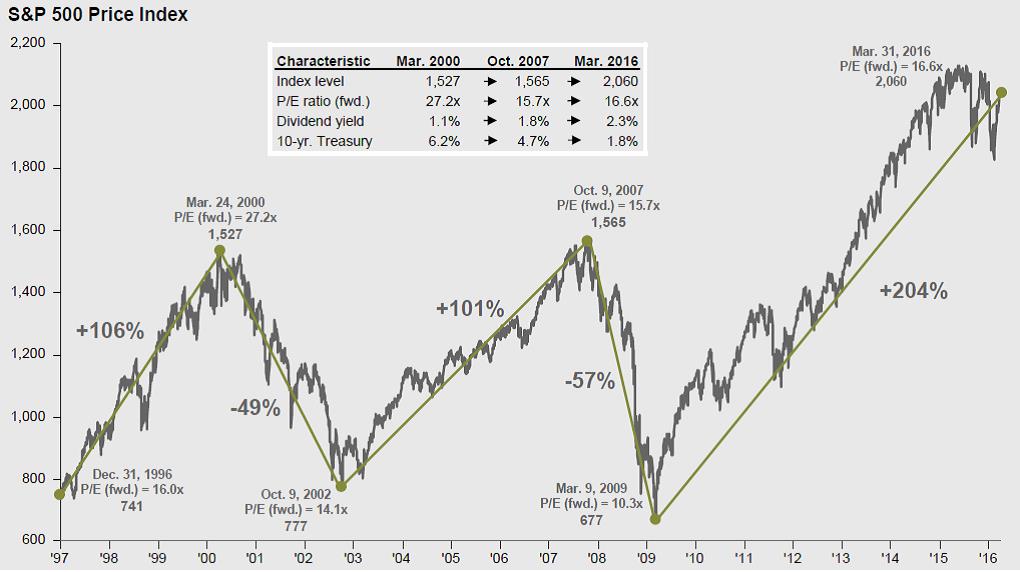

Poor Investor Behavior: The stock market can be your best friend or your worst enemy. A majority of peoples’ stress comes when the market is in decline. You worked hard, kept a disciplined savings strategy, and now you see your account value tanking. Anxiety and discomfort start to seep in and now you wonder, what should I do? Like any other stressful situation we consider safety and comfort. Sometimes it is a dark room with a movie and a pint of ice cream (perhaps after a bad day at the office), sometimes it is moving your investments to cash and high-quality bonds. The chart below details the US stock market. What we can see are two huge event where market investors’ lost half their value! During these periods of decline an investor has two choices: stay in or sell out. The investor who sold out never appreciated the ensuing recovery, in fact they probably just got more stressed and got a bad case of F.O.M.O. (fear of missing out). The investor who stayed in after each decline was handsomely rewarded throughout the recovery.

Now I said the market can be your best friend, you just have to know how the market works. We cannot expect to consistently achieve positive return without some downside risk along the way. Perhaps staying in and eating ice cream would be a good choice.

Lack of Realistic and Measurable Goals: When was the last time you were a passenger to a new destination and asked the driver, “Do you know where you are going?” and after a little too long of a pause you hear, “I got it”. But do they? As you sit in the passenger seat you start to stress over whether they actually know where they are going or if they are just guessing. By pulling out your phone and typing in the end destination you are effectively making a plan. Same thing goes with planning your financial future. We all have a destination in mind and we all want to know how to get there. By guessing we are more prone to making wrong turns that can lead to more time (delayed goals) and/or changing our plans (reset expectations).

This is only the base, but is a great start to understanding the causes of financial stress and how to approach these common ailments. So have a real conversation, ask the honest questions, and put together a strategy that is going to help you live the life you have always wanted. If you need help, you know where to find me.

Drew Hefflefinger is a CERTIFIED FINANCIAL PLANNER™ at Engage in Wealth in Denver, Colorado. Drew specializes in working with young professionals and retirement savers by helping them preserve and grow wealth while achieving life goals. Drew can be contacted at drew@engageinwealth.com.

[i] J.P. Morgan Asset Management (2016)

[i]

[i]